Lessons I Learned From Tips About How To Deal With A Bill Collector

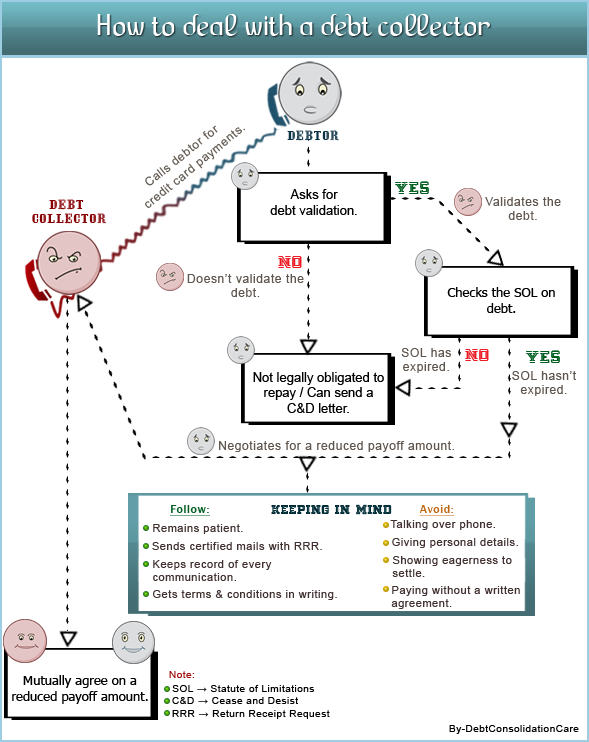

How to deal with debt collectors on your own?

How to deal with a bill collector. Illegal behaviour and debt collection. How to successfully deal with debt collectors 1. It can be easier to negotiate with a collection agency than the original medical service provider.

Deal with them in writing. Can you negotiate with a debt collector on your own? You should request that the bill for the money you owe is sent to you in writing.

Under australian law, a debt collector must not: Should become uncollectible after two years from last payment. If the collection agency contact is by phone call, you may request the debtor send you a debt validation letter to verify the amount the debt.

How to deal with debt collectors 1) don't admit to the debt i know i might sound like a fat cat lawyer here, but seriously, just don't admit to the debt,. Validate and verify within five days of contacting you, a collector must send a written debt validation notice that. If you make an agreement for a payment plan or to settle the debt for less than owed, get the agreement in writing so you can hold the collector accountable.

They are not allowed to “air out your dirty laundry.” so if this happens to you be sure to save the name and phone number that is passed along to you. 8 tips on how to deal with debt collectors. Watch out for old debts.

You can dispute the debt if it's. If the court rules against you and orders you to pay the debt, the debt collector may be able to garnish — or take money from — your wages or bank account, or put a lien on. Avoid paying in cash as it is safer to pay by debit/ credit card or by cheque as there is proof of.