Fantastic Tips About How To Build Credit Without A Credit Card

Instead of strengthening your credit history by borrowing and spending money, you strengthen it by.

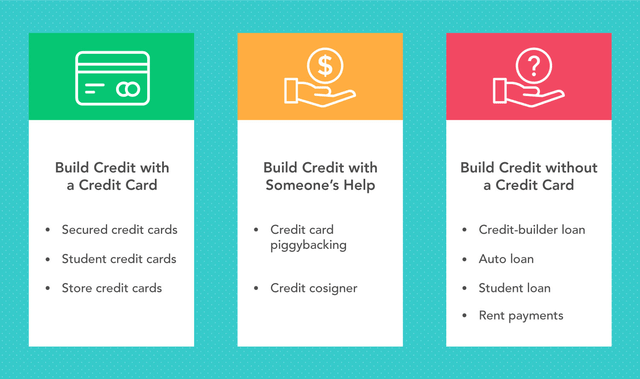

How to build credit without a credit card. Up to 4% cash back one option is experian boost. Cut debt by 50% or more. If your credit profile is lacking sufficient history, or if you have a poor score, a credit builder loan is a great way to establish new credit or improve bad credit.

The average interest rate is 16.17% (based on. New credit scores take effect immediately. This deposit is collateral for the lender, making these.

As you make the required fixed monthly payments over the loan. Consider getting a car loan instead of paying in cash. But you’ll need to have these.

Ad consolidate $20,000 or more. Establishing credit accounts is crucial for building credit without a secured credit card. Apply for an individual credit.

For others, it could take six months to a year. Focus on repaying your student loan on schedule. If you have a phone plan in your name, your payment history may be reported to the three credit.

It charges a steep 26.99% variable apr so you'll. First, when you pay your full statement balance by the due date on your account, you can avoid paying expensive interest charges. The card has few benefits, so if you apply for this card, your goal should be to build your credit score and move on to a new card.

![Tips For Building Credit [Infographic] | Credit One Bank](https://www.creditonebank.com/content/dam/creditonebank/articles/2021/11/A_Few_Good_Ways_to_Build_Credit_Infographic.jpg)